Table of Content

You can use these funds for a range of purposes, including debt consolidation, home improvement projects or higher education costs. The amount you can borrow depends on how much equity you have, your financial situation and other factors. Frost is a great option if you live in the Lone Star State. It’s a good fit for people who just need to borrow a small amount, as loans range from as little as $2,000 to $500,000 or more.

Locking in the shorter duration of a 15-year mortgage now, especially if you’re in your 40s or 50s, allows you to pay it off in time for when you stop working. With a 15-year mortgage, you pay down the principal in half the time you would for a 30-year mortgage, so you accelerate the equity-building process. For example, if you owe $150,000 on a home that cost you $300,000 and today that home is worth $360,000, you have $210,000 of equity in that house.

What is a home equity loan and how does it work?

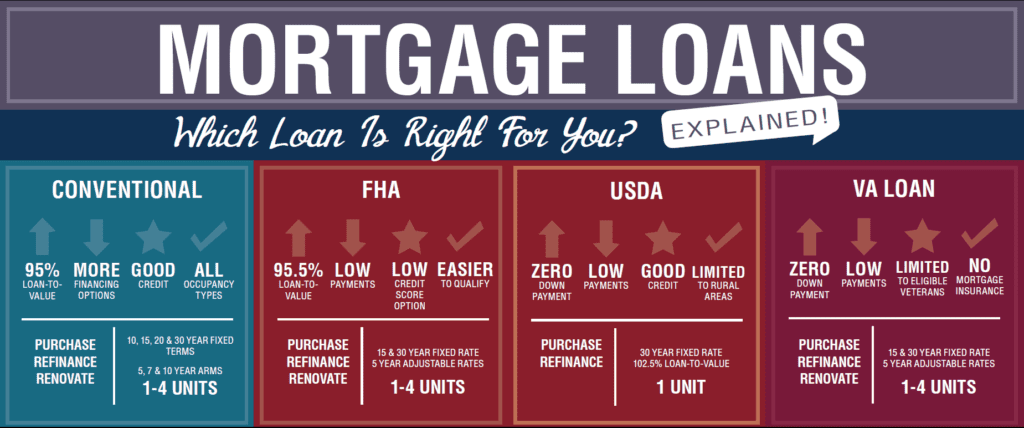

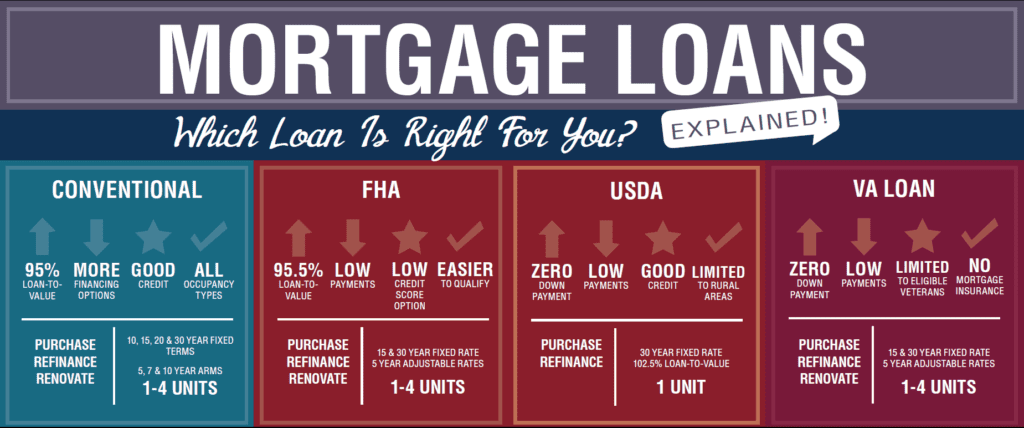

Member is responsible for appraisal costs ranging from $400-$600, if required. Refinancing of existing UW Credit Union home equity loans does not qualify for the closing costs offer. One option is to work with the lender that originated your first mortgage as you already have a relationship and history of on-time payments. Many banks and credit unions also offer discounted rates and other benefits when you become a customer. Mortgage lenders set 15-year interest rates based on a number of factors, but it ultimately comes down to the individual borrower.

The higher yourcredit score, the better your rates and the more likely you are to be approved. If you have a credit score in the mid-600s or below, work to pay off existing debt and make timely payments on your credit cards toimprove your score. Third Federal offers home equity loans and HELOCs featuring long repayment terms, potentially low interest rates and few fees. The table below brings together a comprehensive national survey of mortgage lenders to help you know what are the most competitive 15-year mortgage rates.

Third Federal Savings and Loan: Best home equity line of credit with a long repayment term

BMO Harris has a standard variable-rate HELOC, but you can also lock in all or part of your line at a fixed rate for a five- to 20-year term. You can also use a home equity loan in the event of an emergency like unplanned medical expenses. If you can't pay back the loan, the lender can seize your home to repay your debt. One potential downside of a home equity loan is that if your property value goes down for any reason, you could end up underwater on your loan. This happens when the balance of your loan becomes higher than the value of your home. That's what happened to millions of Americans during the2008 financial crisis.

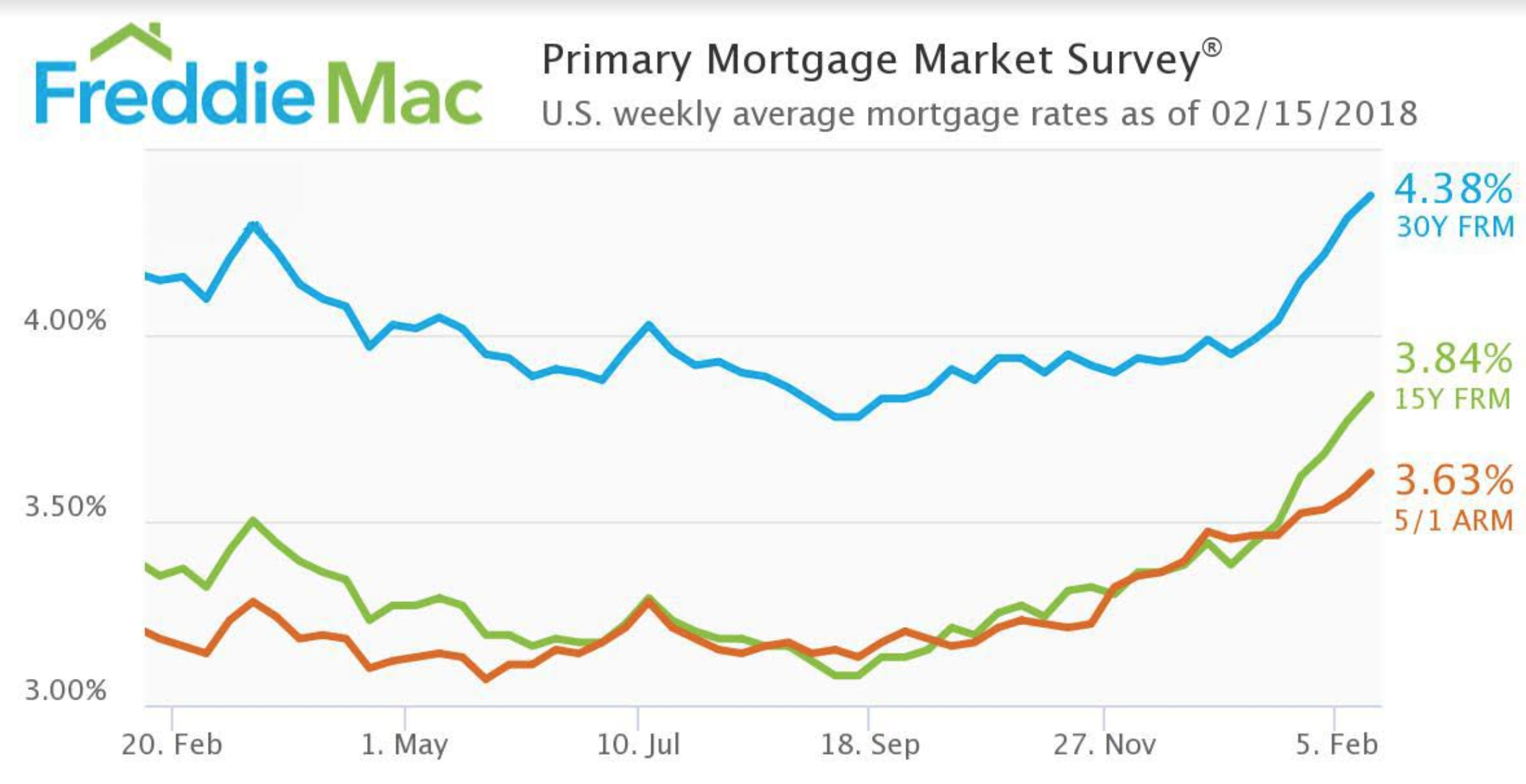

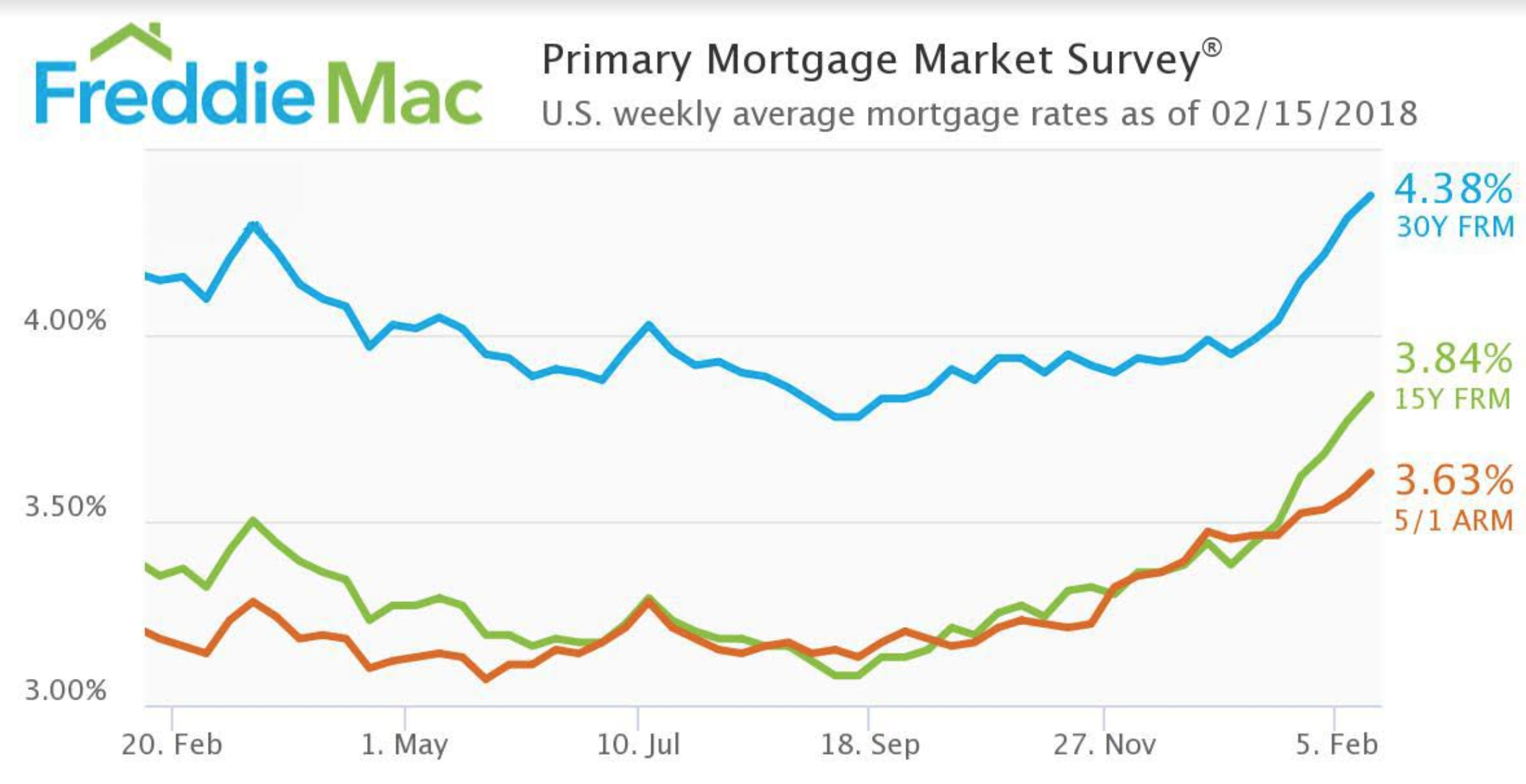

Rates for adjustable rate mortgages are subject to change at the end of their respective fixed rate terms. This information is accurate as of the date of the latest update and is subject to change without notice. Individual interest rates will vary depending upon loan details such as loan-to-value, credit history, property type and occupancy.

Fastest Closing Time

There’s a $99 origination fee, and you may have to pay closing costs on certain accounts. Bank of America offers HELOCs in all 50 states and Washington, D.C., and nixes a lot of fees that other banks charge. Most lenders will allow you to borrow anywhere from 15% to 20% of your home's available equity. To calculate your home equity, subtract your remaining mortgage balance from the current appraised value of your home. How much equity a bank or lender will let you take out depends on a number of additional factors such as your credit score, income and DTI ratio. For most homeowners, it can take five to 10 years of mortgage payments to build up enough tappable equity to borrow against.

Bankrate's home equity line of credit rate offers help you compare interest rates, fees, terms and more as you start your search for a loan. The resources below also serve as a starting point for learning about how home equity works and when a HELOC is a good option. If you do, lenders will then take into account your credit score, income and current DTI to determine whether or not you qualify and your interest rate. Offers you a lump sum of cash that you borrow against the equity built in your house. Represent the weekly average interest rate among top offers within our rate table for the loan type and term selected. Use our rate table to view personalized rates from our nationwide marketplace of lenders on Bankrate.

Please review the applicable privacy and security policies and terms and conditions for the website you are visiting. Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances. For personal advice regarding your financial situation, please consult with a financial advisor. A home equity loan, also called a second mortgage, lets you borrow against the equity you've built up in your home through your down payment, mortgage payments and increased home value. HELOC interest rates tend to be lower than interest rates for home equity loans and personal loans.

Tower Federal Credit Union offers low rates on credit cards, vehicle loans, mortgages, home equity loans and personal loans. HELOCs offer greater flexibility, like the ability to pay interest-only for a 5 to 10 year draw window, and then switch to a regular amortizing or balloon payment. When you have a HELOC you may be charged a small nominal annual fee - say $50 to $100 - to keep the line open, but you do not accrue interest until you draw on the line.

PNC's website is not upfront about information like interest rates and term lengths unless you input details about your home, which could make it harder to compare broadly across lenders. Additionally, the fixed-rate option requires a $100 fee each time you lock or unlock a rate. PNC's HELOC lets you borrow up to 84.9 percent of your home's value, and you can get a discount on your rate if you set up automatic payments from a PNC checking account. There’s an annual fee of $75, though it’s waived in the first year. And while most banks let you convert some or all of your balance to a fixed-rate loan, Flagstar’s APR remains variable for the life of the loan. Flagstar's loan offerings also vary by ZIP code; the details here are presented for the ZIP code.

However, these often come with many fees, and variable interest accrues continuously on the money you receive. Lower lets you borrow up to 95 percent of your home's value, while most other lenders cap LTV at 80 or 85 percent. Now, borrowers with excellent credit and sufficient equity can secure home equity loans with interest rates as low as 5% to 6%, according to Bankrate. For example, if you have a $500,000 mortgage and you owe $350,000 on it, you have $150,000 in equity.

A U.S. Bank personal checking account is required to receive the lowest rate, but is not required for loan approval. Customers in certain states are eligible to receive the preferred rate without having a U.S. The rate will never exceed 18% APR, or applicable state law, or below 3.25% APR.

A month ago, the average rate on a 30-year fixed refinance was higher, at 6.91 percent. At the current average rate, you'll pay principal and interest of $640.64 for every $100,000 you borrow. The average rate on a 5/1 adjustable rate mortgage is 5.50 percent, rising 3 basis points over the last 7 days. At the current average rate, you'll pay a combined $640.64 per month in principal and interest for every $100,000 you borrow. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories.

year vs. 30-year mortgage interest and payments

Ahome equity loan, on the other hand, offers more predictability in terms of monthly payments, since you'll receive a large sum of money upfront and pay it back in monthly installments with a fixed interest rate. Home equity loans are usually best for people who need a lump sum right away and want a predictable monthly payment. Rates are as low as 6.640% APR and are based on an evaluation of credit history, CLTV (combined loan-to-value) ratio, loan amount and occupancy, so your rate may differ. For loan amounts of up to $250,000, closing costs that members must pay typically range between $300 and $2,000. The closing costs depend on the location of the property, property type, and the amount of the Equity loan. Rates are subject to change—information provided does not constitute a loan commitment.

No comments:

Post a Comment